Mobility is transforming. As cities worldwide push toward cleaner, smarter transportation systems, Mobility as a Service (MaaS) and its electric variant, e-Mobility as a Service (eMaaS), have emerged as foundational paradigms in future mobility ecosystems. eMaaS integrates electric vehicles (EVs), digital infrastructure, and multimodal services into a seamless, sustainable offering. This article explores the dense, evolving landscape of emobility, focusing on technology, infrastructure, business models, and market trends as of 2025.

What is e-Mobility as a Service?

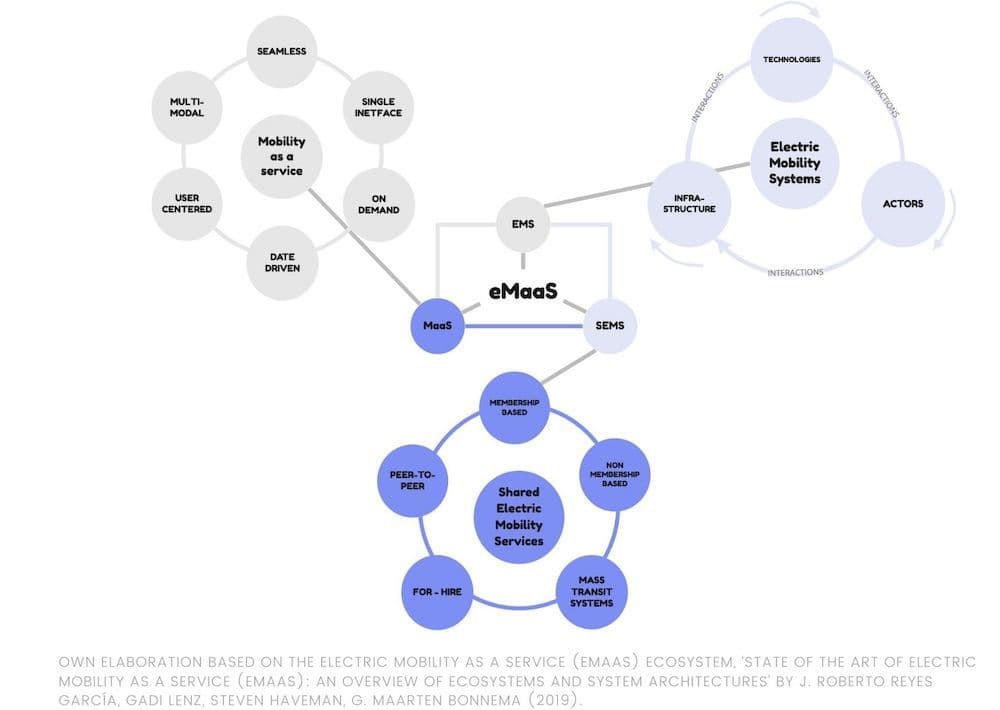

At its core, eMobility as a Service (eMaaS) is the convergence of Mobility as a Service (MaaS), Electric Mobility Systems (EMS), and Shared Electric Mobility Services (SEMS). It aims to enable:

- Environmentally friendly travel via electric vehicles

- Interconnected services that span car sharing, public transport, and EV charging

- Unified platforms supporting both real-time access and payment

MaaS provides the digital and structural backbone, while EMS delivers the hardware and infrastructure. Together, they enable SEMS such as electric scooters, e-bikes, or car-sharing fleets.

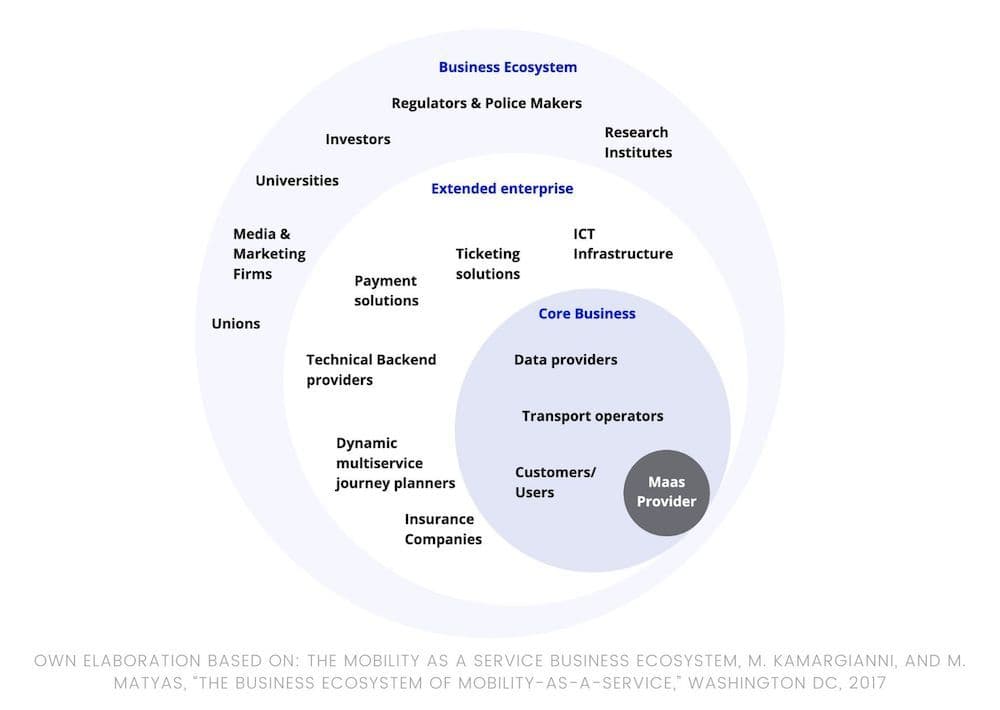

eMaaS ecosystem players:

- Users: drivers, commuters, logistics providers

- Service providers: CPOs, eMSPs, OEMs

- Governments & municipalities: regulation, incentives

- Platforms: integrators offering app-based access to services

Market drivers in 2025

1. Urbanization and climate policies

More than 70% of the global population is projected to live in cities by 2050. To combat pollution and congestion, governments implement regulations and incentives to promote e-mobility.

2. EV adoption and infrastructure expansion

Global EV sales are expected to exceed 30 million annually by 2030. The supporting infrastructure - fast chargers, smart grids, better charger maps, and roaming networks has grown by over 400% since 2020.

3. User expectations

Digital natives expect instant, seamless, app-based access to multimodal transport. User-centricity is no longer optional; it's foundational.

Technology backbone of e-Mobility as a Service

Charging protocols and standards

The growth of eMobility depends heavily on open, interoperable protocols that ensure devices, platforms, and networks communicate seamlessly. In 2025, several mature standards are critical to enabling effective ecosystem operations:

Open Charge Point Protocol (OCPP)

OCPP has evolved into the global benchmark for communication between EV charging stations and central systems. Supported by the Open Charge Alliance (OCA), OCPP 2.0.1 includes:

- Enhanced security features (e.g., secure firmware updates, authentication)

- Support for smart charging and load management

- Device management functionalities to remotely monitor, configure, and update chargers

- Real-time data exchange to optimize network performance and uptime

The protocol’s vendor-neutral design promotes flexibility, allowing charge point operators (CPOs) to mix and match hardware and software without vendor lock-in.

Open Charge Point Interface (OCPI)

OCPI facilitates interoperability between CPOs and eMobility Service Providers (eMSPs). It supports:

- e-Roaming by enabling cross-platform user identification and authorization

- Remote control of charging sessions (e.g., start/stop commands)

- Standardized Charge Detail Records (CDRs) for billing reconciliation

- Real-time pricing and location data for user interfaces

OCPI enables scalable growth across borders and partners, forming the backbone of European roaming platforms like Hubject and GIREVE.

This international standard empowers Plug & Charge capabilities, allowing drivers to start charging simply by plugging in their vehicle. Key components include:

- Bi-directional vehicle-to-grid (V2G) communication

- Public key infrastructure (PKI) for secure data exchange

- Digital contracts between EVs and CPOs

ISO 15118 improves the user experience by removing RFID cards, apps, or QR codes, and supports seamless automated billing.

These protocols ensure that e-mobility networks are scalable, secure, and user-friendly. As EV adoption grows and roaming becomes the norm, adherence to open standards is critical for long-term market interoperability and customer satisfaction.

Smart charging and V2G

Smart charging has become the basis of efficient energy use in the e-mobility ecosystem. Modern smart charging platforms:

- Connect EVs, grid operators, and charge point operators in real time

- Integrate dynamic load balancing to avoid overloading local grids

- Optimize charging based on energy pricing, time-of-use tariffs, and renewable energy availability

- Enable demand response by shifting energy usage to off-peak periods or in response to grid signals

A major advancement is the rise of Vehicle-to-Grid (V2G) systems, which allow electric vehicles to consume electricity and return it to the grid. V2G platforms:

- Support bidirectional energy flow between EVs and the grid

- Provide grid balancing, frequency regulation, and emergency power

- Offer financial incentives to EV owners who participate in energy markets

As V2G monetization models mature, they are increasingly integrated into residential, commercial, and fleet operations, offering a new revenue stream for asset owners and reducing dependency on stationary battery storage.

Battery innovations

Battery technology is critical to the expansion of e-mobility as a service. By 2025, the average battery electric vehicle (BEV) delivers 350-400 km per charge, enabled by continuous advancements in battery chemistry and design.

- Lithium-ion (Li-ion): Li-ion batteries are widely adopted due to their high reliability and rechargeability. Manufacturers are enhancing performance through new chemistries like NMC and LFP.

- Solid-state: Featuring solid electrolytes, these batteries offer higher energy density, ultra-fast charging (<15 minutes), and improved safety, key for scaling e-mobility solutions.

- Aluminum-ion: Known for shorter charge cycles and greater recyclability, aluminum-ion batteries show promise for lightweight urban e-mobility applications.

- Lithium-sulfur: With 5x the energy density of Li-ion, these are ideal for long-range electric mobility but still face durability challenges.

- Metal-air: Lightweight and powerful, but hindered by rechargeability issues. Research continues toward viability for long-distance EVs.

Battery cost, lifecycle & SALD technology

Battery costs have plummeted, reaching near $100/kWh, making emobility cost-competitive.

- Second-life use: Repurposed EV batteries now power stationary storage systems, adding value and extending lifespan.

- SALD batteries: An evolution in e-mobility innovation, these nano-coated lithium-ion batteries promise >1,000 km range and sub-10-minute charging. Commercial rollout is expected by 2027.

- Recycling & regulation: With EU battery directives and leaders like Fortum and Northvolt, circular battery ecosystems are now integral to sustainable emobility platforms.

- Battery swapping: It offers a quick alternative to charging by replacing a depleted battery with a fully charged one in just minutes.

Battery innovation is foundational to scaling mobility as a service. High-density, fast-charging, and recyclable solutions are unlocking the full potential of the eMobility as a Service (eMaaS) ecosystem.

Business models in eMobility

The success of eMobility as a Service hinges on flexible, user-centric business models. From pay-per-use systems to subscription-based access and dynamic e-mobility tariffs, these models are designed to adapt to diverse user needs while maximizing accessibility, scalability, and profitability across the e-mobility ecosystem.

1. Free-floating car sharing

EVs can be picked up and dropped off anywhere within defined zones. Providers like Zity and ShareNow thrive in high-density areas.

2. Station-based car sharing

The traditional model is where vehicles must be returned to a fixed location. Ideal for regional use and longer rentals.

3. Peer-to-Peer (P2P) sharing

Privately-owned EVs are rented through platforms like Getaround. This model democratizes mobility access and enhances fleet diversity.

4. Subscription and on-demand access

Integrated mobility platforms offer:

- Subscription plans: Monthly packages tailored for families, commuters, or businesses

- Pay-as-you-go: Unified ticketing and payment across multiple modes

Charging infrastructure in 2025

EV Charging Technologies and Infrastructure

A robust and accessible EV charging network is essential to scale eMobility as a Service. The evolution of EV charging infrastructure focuses on speed, flexibility, and grid integration, meeting the demands of modern urban e-mobility users.

Bidirectional chargers

They enable two-way energy flow. These EV charging stations support both charging (AC to DC) and discharging energy back to the grid or a building (V2G, V2H), optimizing energy use.

Wireless charging

Vehicles can charge wirelessly by parking over ground-installed pads, much like smartphone chargers but with much higher energy transfer. Startups like ELIX are advancing park-and-charge EV technology for urban use.

High-speed chargers

Designed to replicate the refueling experience, these EV charging stations can power a vehicle in 20–60 minutes. Leading providers like Tesla, ChargePoint, and EVBox are pushing toward the <10-minute benchmark, although this requires advanced thermal management.

Portable charging units

Mobile charging systems, like SparkCharge, function as EV power banks, delivering 60–75 miles of range per stack—ideal for roadside and emergency charging.

Charging-as-a-Service (CaaS)

Providers such as ZUMO offer full-service overnight charging by collecting and returning vehicles, addressing the needs of EV owners without home charging access in dense cities.

Dynamic wireless charging

Implemented in pilot programs in Sweden, Italy, and Germany, this technology powers vehicles while in motion using coils embedded under the road surface, bridging gaps in static charging coverage.

Smart charging

These systems connect EVs, users, and the grid through a centralized platform. Smart EV charging stations optimize electricity use based on pricing, grid load, and user preferences. They support demand response, power-sharing, and remote session management. Solutions like Wallbox are now standard in homes, condominiums, and workplaces.

Traditional cable-based charging

The market includes three levels: rapid (up to 80% in 20–60 minutes), fast (4–6 hours), and slow (6–12 hours). Standards like CHAdeMO, CCS, and Type 2 define compatibility across EV models. Most public EV charging stations today fall into the fast-charging category, located at commercial and public areas such as supermarkets, city centers, and business parks.

Despite rapid advancements, coverage and convenience remain the biggest hurdles. While home charging is still dominant, public EV charging infrastructure must keep pace. Scalable, well-integrated EV charging networks backed by city planning and private innovation are central to ensuring the success of electric mobility as a service.

Interoperability and e-Roaming

Platforms like Hubject and GIREVE enable users to charge across networks with a single ID. This enhances user trust and streamlines billing.

e-Roaming and Interoperability

As the eMobility as a Service ecosystem scales, seamless access to a diverse EV charging network becomes essential. e-Roaming, akin to mobile roaming, enables EV drivers to use charging stations across multiple operators and regions with a single account or service provider.

This is made possible through interoperability agreements facilitated by roaming hubs (e.g. Hubject, GIREVE) and standardized protocols like OCPI.

E-roaming platforms allow users to:

- Locate and access any compatible EV charging station, regardless of operator

- Initiate and pay for charging sessions using their existing eMobility service provider (eMSP) account

- Receive unified billing and transparent usage data

This interoperability improves driver convenience, boosts confidence in EV adoption, and significantly enhances the user experience by eliminating the need to juggle multiple apps, subscriptions, or RFID cards.

From a business perspective, e-roaming opens new revenue streams for charge point operators (CPOs) by increasing station utilization and attracting a wider customer base. It reduces friction in cross-border travel, supports fleet electrification, and is key to establishing a unified European EV charging infrastructure.

Despite its value, e-roaming adoption remains uneven. Many EV charging networks still operate in silos, limited by competitive concerns or lack of technical integration. However, industry bodies and government initiatives are increasingly pushing for open access, recognizing that interconnected EV charging platforms are foundational to scaling electric mobility.

For CPOs and eMSPs building or expanding their networks, e-roaming should be a core functionality integrated from the outset or included in upgrade roadmaps through collaboration with experienced software providers. The result is a more resilient, user-focused, and sustainable eMobility ecosystem capable of meeting the needs of modern drivers across regions and borders.

Policy & regulatory momentum

European Union, Germany, Norway, and the Netherlands are frontrunners in e-mobility regulation:

- EV purchase subsidies and tax relief

- Grants for installing charging infrastructure

- Public transport electrification funds

- Emission-free vehicle mandates by 2030

These policies are backed by over €20B in annual public investment across Europe alone.

Data, UX, and personalization

Users expect:

- Integrated route planning

- Real-time vehicle availability

- Transparent pricing

- Predictive maintenance and proactive notifications

Surveys in 2023 show 75% of users are willing to share vehicle data if they receive actionable insights in return (e.g., early repair detection, alternative routing).

Looking forward

eMobility is no longer a trend; it's the backbone of future transport. For cities, operators, and developers, the challenge is no longer "why," but "how fast."

The depth and breadth of e-mobility as a service underscore its role in shaping a sustainable, user-centric future. As technology evolves and adoption increases, players that prioritize agility, openness, and user value will lead the next mobility revolution.

Solidstudio, with its expertise in building modular platforms, integrating open standards like OCPP/OCPI, and supporting scalable mobility services, is poised to support this transition. As e-mobility as a service scales, platform interoperability, robust data exchange, and user-centric design will define success.

Download our ebook: The Growing Concept of eMobility, or book a consultation to discuss your case!