Introduction

Artificial intelligence (AI) is currently one of the hottest buzzwords of the tech scene. IT professionals in the financial industry services sectors were among the first ones to realize what business benefits it may bring to banking companies. As a result, financial institutions were among the early adopters of the technology, paving the way for AI to spread across other industries.

In particular, FinTech >> companies were the ones to jump on the AI bandwagon early on. They were followed by large banking institutions with multi-million dollar budgets to spend on digital transformation and solutions based on AI technologies such as machine learning (ML).

No wonder that the organizations in the financial sector became the primary drivers of AI Research and Development initiatives in FinTech. They're also projected to be the ones to support the FinTech startup ecosystem and bridge the AI knowledge gaps in other, more traditional sectors.

Autonomous Research >> predicts that by 2030, AI technologies will allow banking institutions to reduce their operational costs by 22%. In the long run, the savings achieved by financial institutions, thanks to AI are expected to reach $1 trillion.

Benefits of AI in FinTech

Why are so many FinTech startups and large banks investing in AI? Here are a few good reasons why AI has gained such a prominent position in the financial services tech scene.

Data-driven management

One of the critical strengths of AI solutions is their efficiency in handling unstructured data, be it images, videos, geographical location, transactions, and time series. That's why AI-powered solutions are used to assess risks and improve risk management, grant credit scores, detect fraud, automate claims cases, and much more. AI solutions allow introducing a different style of management that is based on insights from data. In the future, banking leaders will be asking strategic questions to machines, in addition to human experts. Able to analyze massive collections of data, machines will support key aspects of decision-making.

Predictive analytics

In financial services, predictive analytics solutions will be used to shape the overall business strategy of FinTech organizations, nurture sales, optimize resource use, and generate revenue. Such tools will gather and arrange data, analyze it using cutting-edge AI algorithms to deploy customized solutions for internal users or customers.

Experts predict that AI will take current predictive analytics tools to the next level. It will help organizations boost internal processes and improve their operational efficiency – all in the effort to build a competitive advantage.

For example, predictive analysis tools will be responsible for calculating credit scores, and offering FinTechs insights about the future decisions of customers or employees (for example, what a consumer is going to buy).

Automated customer support

Another critical area where AI technologies bring tangible value is customer service and relationship management. Banks can use AI-powered chatbots >> to provide prompt replies to customer queries and improve the overall experience clients have with their products and services. Such chatbots will be able to deliver human-like customer service and offer expert advice at a meager cost to the organizations. What's more, chatbots can be available 24/7 and never take days off.

Virtual assistants can be enriched with AI as well to help walk the customer through the bank's offer, improve the user journey, and provide personalized calls to action to increase goal conversions. Both chatbots and virtual assistants will help FinTech organizations save time and money on providing customer service, all the while improving their quality thanks to the capabilities of AI.

Fraud detection

AI-powered analytics tools constantly analyze data to detect suspicious transactions that could be fraudulent. AI solutions can monitor behavioral patterns of users and identify actions that depart from the norm and could indicate fraud attempts or incidences. These instances will be then transferred to human employees for consultation, saving them plenty of time.

Claims management

Another area that stands to benefit a lot from AI is claims management. Machine learning is already being built into different stages of claim handling mechanisms. Banks are now taking advantage of AI to handle a massive amount of data is short timeframes. That's why AI solutions will reduce the overall processing time of claims and their costs – all the while improving the customer experience by making handling specific claims faster. Moreover, AI systems are continually learning from the data they process and will be able to adapt to new, previously undiscovered cases, enhancing their detection capabilities over time.

Insurance management

AI will have a huge impact on insurance management, as well. Such tools will help automate the underwriting process and process more data to make the best possible decisions for customers. Financial services companies will take advantage of automated agents who will assist users online, supporting them at every step of the way in identifying insurance requirements. AI solutions will accelerate the underwriting process and help to integrate different sources of data for more precise assessment. Insurance providers will use AI solutions to identify risks and then lower the probability of damages to the party insured, as well as the insurer.

Wealth management

FinTechs are busy applying AI to services that were previously reserved for select groups of customers. For example, they offer digital and wealth management advisory services to lower net worth market segments at relatively low fee-based commissions. An example of such an implementation is smart wallets. An AI-powered smart wallet monitors and collects insights about a user's behavior and actions to help them change their personal finance habits for saving purposes.

Virtual financial assistants

Another solution adjacent to automated wealth management tools is a virtual financial assistant. FinTech companies will be developing such a tool to deliver outstanding customer experience. Virtual financial assistants and planners will help customers make the best financial decisions. They will monitor events, identify and report on stock and bond price trends in relation to the user's financial goals and portfolio. They will make data-driven recommendations of bonds and stocks to sell or buy. Such robotic advisors are becoming increasingly popular among both cutting-edge FinTech startups and established financial companies.

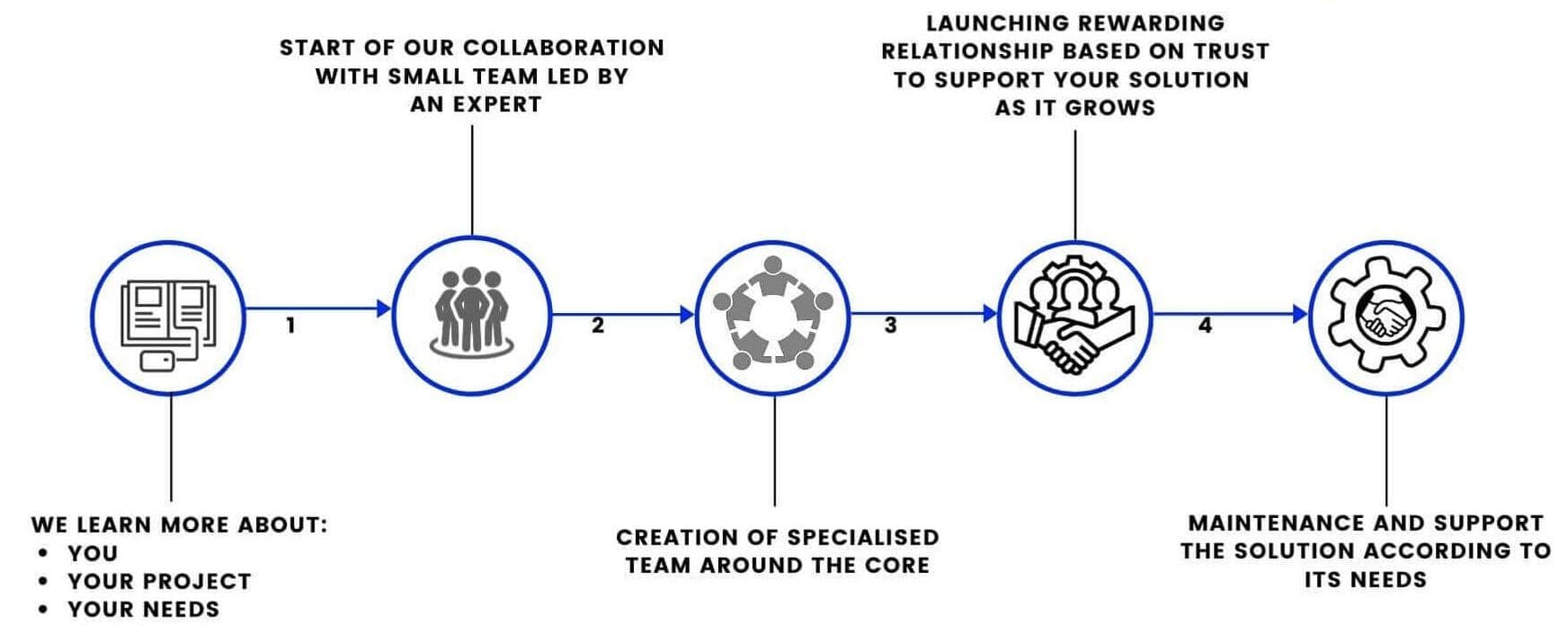

Our process

FinTech AI use cases

Now that you know why AI offers such potential to organizations in the financial services sector, here are a few FinTech use cases that make use of AI.

Automating the analysis of loan agreements

JP Morgan is using AI to revamp its loan agreement analysis. The bank has recently introduced a brand new product called the Contract Intelligence platform (CoiN) customers can use to analyze such agreements, underline the key terms and conditions, and identify critical data. In the past, the same work took JP Morgan's employees 360 thousand working hours to complete.

Developing innovative payment technologies

Bank of America is planning to revolutionize the way we use ATMs with an AI-powered virtual assistant. The assistant is integrated into the bank's mobile app and a number of ATMs all over the US to enable customers to navigate the bank's offer better.

Another American bank, Wells Fargo, has recently announced that it's looking to create a special AI team which will be responsible for payment technologies and enhancing services for corporate clients. The team is set to create a technology that will enable the bank to deliver a more personalized customer experience in the online channels by making relevant recommendations on financial products.

Collaborations with FinTech startups

Many large banks are now investing in and forging collaborations with innovative FinTech startups to get access to cutting-edge technologies. An example of such a strategy is Citi Bank, which has invested in several AI startups like Feedzai that use AI to fight fraud.

The takeaway

The emergence of AI had a massive impact on technological developments in the financial services space. Because of its many potential benefits, we can expect a radical increase in automation in the financial industry. Some of these automation solutions will implement AI algorithms to perform sophisticated tasks and learn from the data sets which they process.

Innovative technologies such as artificial intelligence offer the financial sector an unprecedented opportunity to reduce costs, improve the customer experience, and increase operational efficiency.

But the path to advanced AI adoption in banking is riddled with specific. For example, large banks suffer from a lack of qualified data analytics specialists and qualified AI developers. That's why they turn to specialized software development agencies that provide skilled engineers with experience in FinTech. Such teams will be instrumental in diagnosing, conceptualizing, developing, and commercializing these new solutions.

Are you looking for a team of AI developers who work in FinTech? Get in touch with our consultants, we help FinTech startups and large banks to make the most of innovative technologies.