Having already delivered a ton of tech-focused materials, the time has come that we’ve talked a bit more about the business side to software within the EV charging sphere. In our latest webinar Paweł Małkowiak shed more light on the financial aspects of acquiring and maintaining EV charging software, including the third way - a business model often overlooked by many operators and software companies alike.

Webinar - key takeaways

eMobility Software Overview

Paweł kicked off with a quick overview of the eMobility software landscape, identifying the key players and their roles:

- Charge Point Operators (CPOs): Manage the charging networks.

- eMobility Service Providers (EMSPs): Offer charging services to EV drivers.

- Open Standards like OCPP (Open Charge Point Protocol) and OCPI (Open Charge Point Interface): Ensure interoperability between different systems, enabling seamless integration across various platforms.

Software Purchasing Options

The main part of the webinar focused around the ways in which one may acquire software and who would benefit from them the most.

Software as a Service (SaaS)

SaaS provides a quick setup process, allowing companies to get started with minimal initial investment. Additionally, SaaS solutions come with ongoing updates and support, ensuring that the software remains up-to-date and any issues are promptly addressed. However, there are some drawbacks to consider. The operational costs associated with SaaS tend to increase linearly over time, which can become significant as usage grows. There are also potential issues with data ownership, as the data resides on the service provider's servers. Furthermore, because SaaS solutions are shared among multiple users, companies might find it challenging to gain a competitive edge due to the standardized features available to all users.

Custom Software Development

By choosing this route, companies gain full ownership of their software, allowing them to create tailored solutions that provide unique competitive advantages. This can lead to potential long-term cost savings and an increase in company valuation through the creation of proprietary intellectual property. However, custom development also comes with notable challenges. It requires significant time and financial investment to develop the software from scratch. There is also the risk of "reinventing the wheel," where companies may spend resources developing functionalities that already exist in other solutions. Additionally, businesses will need to establish and maintain an in-house IT department or rely on outsourced IT services to support the ongoing development and maintenance of the software.

Licensing

Licensing offers a balanced approach, combining the quick deployment characteristic of SaaS with the control typical of custom development. This model provides a perpetual source code license, ensuring no vendor lock-in and granting businesses the flexibility to modify the software as needed. Additionally, at Solidstudio, with license we offer optional ongoing support, helping maintain and update the software over time. However, there is an initial licensing fee to consider, although this fee is significantly lower than the costs associated with developing custom software from scratch or even some SaaS solutions in the long run.

How does it work?

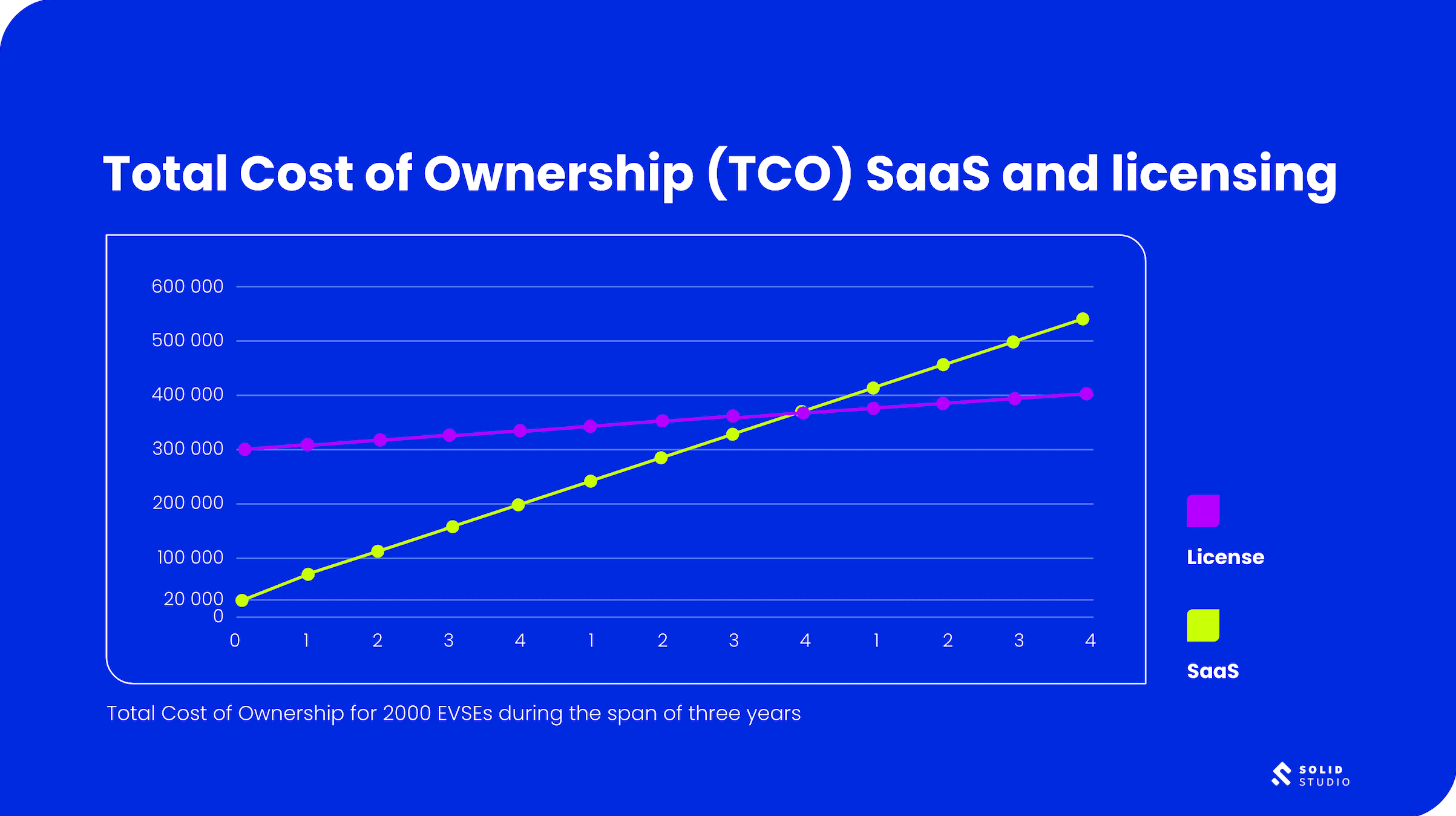

Licensing costs are generally much lower than standard SaaS pricing components. To illustrate this, consider a basic example of a Charge Point Operator managing 2,000 EVSEs using a SaaS provider. The SaaS provider charges a €20,000 onboarding fee and €7.5 per EVSE per month. Over a three-year period, the total operational cost for accessing the tool exceeds half a million euros.

In contrast, consider the licensing model. An exemplary license fee might be €300,000, depending on the software's scope. This includes support and maintenance for both the software and infrastructure. The break-even point for a CPO managing 2,000 EVSEs is just after two years. Beyond this point, significant savings accrue, and the longer the timeframe, the greater the savings.

Not to mention, this example does not factor in the dynamics of increasing EVSEs, in which case, the SaaS costs would skyrocket even higher. It is clear that to meet future goals, such as those set for 2030 or 2035, infrastructure will need to expand significantly. As the number of EVSEs under management grows, the break-even point will arrive sooner, and the operational cost savings will become even more substantial.